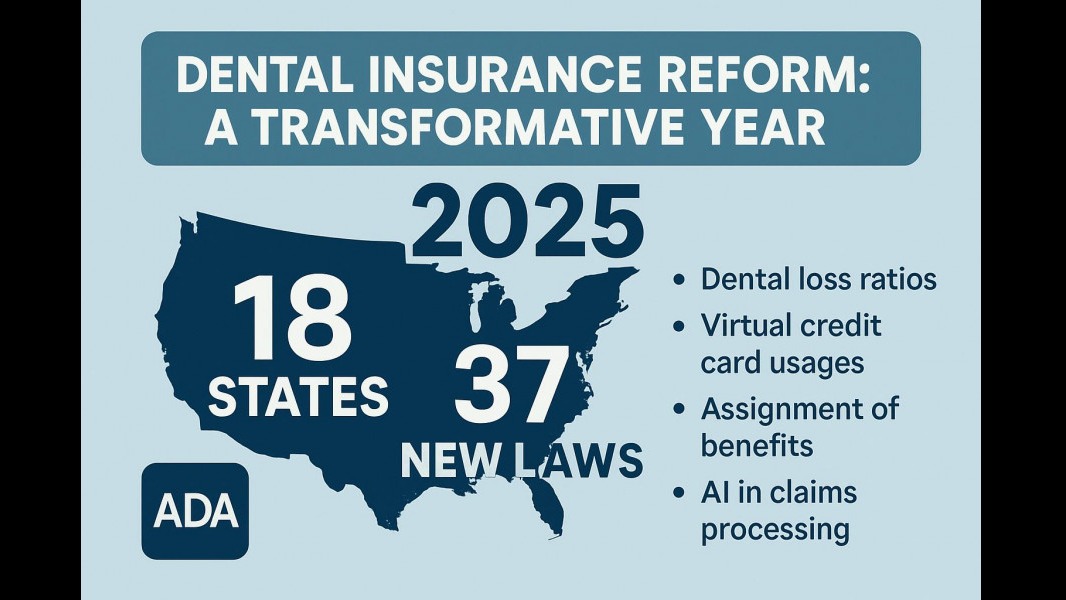

Dental Insurance Reform: A Transformative Year

In 2025, a significant wave of dental insurance reform has swept across the United States, with 18 states enacting 37 new laws, according to the American Dental Association (ADA). This year marks a pivotal moment for dental professionals seeking to overcome longstanding challenges within the insurance landscape. With more than 120 legislative proposals filed, the reforms aim to address critical areas such as dental loss ratios, virtual credit card usages, assignment of benefits, and the integration of artificial intelligence in claims processing.

Understanding Dental Loss Ratios

The concept of dental loss ratios is at the forefront of this year's reforms. Essentially, a dental loss ratio measures the percentage of insurance premiums allocated to actual dental care rather than administrative costs. Fifteen states introduced bills to establish these ratios, leading to successful enactments in Montana, North Dakota, and Washington. The outcome will not only provide transparency regarding how much insurers are spending on care versus profits but also push for higher standards in the industry.

Empowering Dentists with Assignment of Benefits Laws

In an effort to protect patient choices and foster greater access to dental care, several states have enacted assignment of benefits laws. These laws mandate that dental insurance companies pay dentists directly for services rendered, regardless of network affiliation. This reform is crucial as it ensures that patients can access the care they need without the added burden of navigating complex reimbursement processes. Illinois, Kentucky, and Nevada have successfully passed such legislation, empowering dentists and their patients alike.

Virtual Credit Cards: New Protections for Dentists

With the increasing adoption of virtual credit cards for claims payments, new laws in states like California, Maine, North Dakota, Oklahoma, Utah, Virginia, Washington, and Wyoming establish critical safeguards for dentists. These laws require insurers to inform dental providers about associated fees of using virtual credit cards and to offer alternative non-fee payment options. This change is essential as it protects practices from unexpected costs effectively, allowing them to maintain focus on patient care. California's new requirement for affirmative consent provides robust protection against default practices that favor insurance companies.

The Role of Artificial Intelligence in Insurance Processing

In an era characterized by rapid technological advancements, 20 states introduced legislation aimed at regulating the use of artificial intelligence in claim payment adjudication. The intent behind this legislation is to ensure that human oversight remains integral in the claims process, thus preserving the integrity and fairness of insurance assessments. Arizona and Maryland have successfully enacted measures that lay the groundwork for responsible AI integration in the industry. As AI continues to evolve, maintaining a balance between efficiency and empathy in claims processing is paramount.

What These Changes Mean for Dentists

For dentists like Dr. Emily Johnson, these legislative changes are a beacon of hope. The landscape of dental care is rapidly shifting towards greater accountability and transparency, which aligns with her values as a practitioner dedicated to integrity and patient trust. The reforms can potentially enhance the operational capacity of dental practices, foster better patient relationships, and ultimately improve health outcomes.

Looking Ahead: The Future of Dental Insurance Reform

As the year progresses, there will undoubtedly be challenges related to the implementation of these new laws. Sustained advocacy from organizations like the ADA will be crucial in ensuring the longevity and effectiveness of these reforms. Moreover, dentists and dental associations need to remain vigilant, for even the most well-intentioned laws can face challenges from powerful insurance interests.

Conclusion: Engage with Your Community

The ongoing dialogue around dental insurance reform is a call to action for all dental professionals. Getting involved in local advocacy efforts and staying informed about legislative developments will not only benefit individual practices but also enhance the entire dental community's health. As these reforms begin to take root, the potential for a more equitable, transparent, and patient-centered dental care system is within reach.

Add Row

Add Row  Add

Add

Write A Comment